According to The Economist, just 10% of the world’s population is fully vaccinated against Covid. This average conceals a huge global divide – for low-income countries, the average is just 1%; it is over 30% for the most advanced economies. Even in the developed nations, the formula for vaccine rollout success is a complex blend of politics, economics, public health preparedness and national attitude. But it is clear that the economic bounceback will be led by the largest and most developed economies. Overall vaccination figures show that the global pandemic is far from over; but trends in the credit consensus are already giving some clues to the shape of the expected global economic recovery.

Figure 1 shows the latest credit consensus for corporates and financials globally.

Figure 1: Global Corporates and Financials

After deteriorating by as much as 25%, Corporates have so far recovered about one-fifth of their decline which troughed in February this year; latest data shows the sharpest spike so far. Financials show a similar pattern after a more modest decline of about 12%.

Rating agencies have also been upgrading in the past few months, following a raft of downgrades in March.

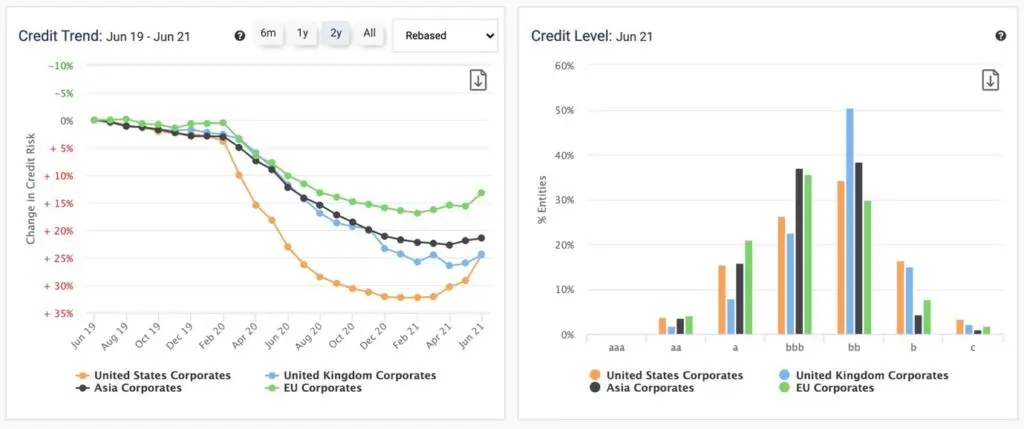

Figure 2 shows the regional trends for corporates.

Figure 2: Corporate credit regional trends

The sharpest recovery is in the US, which troughed in February and has since recovered more than a fifth of its decline. The UK also showed a significant pandemic decline; it is now recovering, but more slowly than the US while analysts await the result of the UK’s reopening experiment. Asia is almost flat after a sizeable decline; EU corporates have made modest but steady increases after an equally shallow decline during the pandemic.

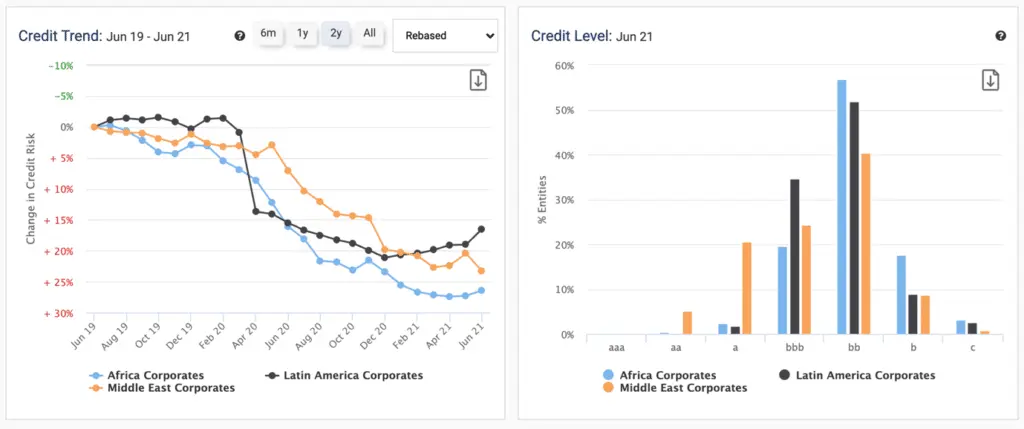

Figure 3 shows the corporate trends for Africa, Latin America and the Middle East.

Figure 3: Africa, Latin America, Middle East credit trends

Despite low average vaccination rates, there are signs of improvement in Africa and especially in Latin America, which has recovered about a quarter of its decline after a surprisingly early turning point at the end of 2020. The Middle East has not, so far, turned the corner.

Consensus credit data suggests that the coming recovery will be broad based and may appear earlier than expected in some of the developing nations. Rising vaccination rates and any sign of a decline in the vaccine mutation rate will underpin these emerging trends.

The latest data is available via the Credit Benchmark Web App, Excel add-in, flat file download, and third-party platforms including Bloomberg. Get in touch with us to request your free trial.